How you approach financial decision making on a day-to-day basis is likely to be the most important ingredient in your life and financial success. The key is to be focused and methodical about how you allocate money to each of your life’s goals on a daily, weekly, or monthly basis. This does not take great discipline or effort. It only takes a little focus and a little chart or reminder that you keep close by for reference.

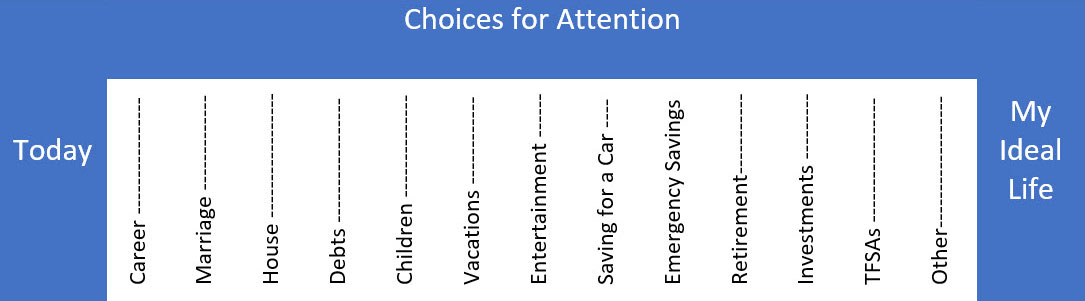

If we look at all your life goals, they typically involve many objectives, including short term, medium and long term, lifestyle, career, family, financial, and others.

One way to share this with you is as a visual reminder by using straight-line continuum. At one end is your starting point and at the other end is your ideal life, as you imagine it to be now, and in the future and as you wish to live it.

The key is to recognize you will always have competing demands on your time, money, and attention. The trick is to allocate resources to all your goals equally over time. It is the consistency with which you address all your goals, not necessarily at the same time, which makes the biggest difference in moving successfully towards the fulfillment of your heart’s desires!

For example, it is easy to spend all your money on daily activities and demands. Reacting and giving in to the immediacy of those demands will mean ignoring those medium- and longer-term goals that are also part of your overall plans and ambitions. This will mean there is nothing left at the end of the paycheque for that week or month for other strategic cash allocations that will benefit you.

If for example, having emergency food or other household supplies on hand is a goal, but you never seem to have that extra $500 handy, then you should consider changing tactics. Instead of setting aside a lump sum, you can buy an extra bag of rice, or cans of peas, or spare tissues or napkins every time you go to the grocery store. Over time, you will achieve this goal without affecting your other lifestyle needs.

The idea is to improve your situation every day, or week, month, or year, in small or large steps. The other benefit is to look at your continuum and see what areas you have neglected over the past month, year or more.

If you have some spare money for this month, then look at your goals and see which areas have been the most neglected and needing of a cash infusion. Perhaps you have not contributed to your retirement account in a couple of years, or you need to review your insurance programs, or you need to address your health or maybe even you need to build in some fun in your life – then allocate your money accordingly.

The key is to address all your goals and needs in every domain of your life consistently over time. Over a longer timeframe, you will be surprised at how many of your goals are met or you achieve considerable progress towards achieving.

Adopting this mind set will allow you to quickly and easily decide how to spend extra cash flow that comes your way such as a bonus, pay raise, inheritance, etc. It may often appear that there is never enough money but using your personal continuum, you can quickly decide which are the best and highest leverage uses of your extra cash. Answering your questions such as “Should I pay down my mortgage or contribute to my RRSP?” will come much more easily to you and your family.

Call us today for a review of your personal cash flow to gain a better understanding about how to achieve your long-term lifestyle and financial goals.

Copyright © 2022 AdvisorNet Communications Inc., under license from W.F.I. All rights reserved. This article is provided for informational purposes only and is based on the perspectives and opinions of the owners and writers only. The information provided is not intended to provide specific financial advice. It is strongly recommended that the reader seek qualified professional advice before making any financial decisions based on anything discussed in this article. This article is not to be copied or republished in any format for any reason without the written permission of the AdvisorNet Communications. The publisher does not guarantee the accuracy of the information and is not liable in any way for any error or omission.